Business Insurance in and around Huber Heights

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

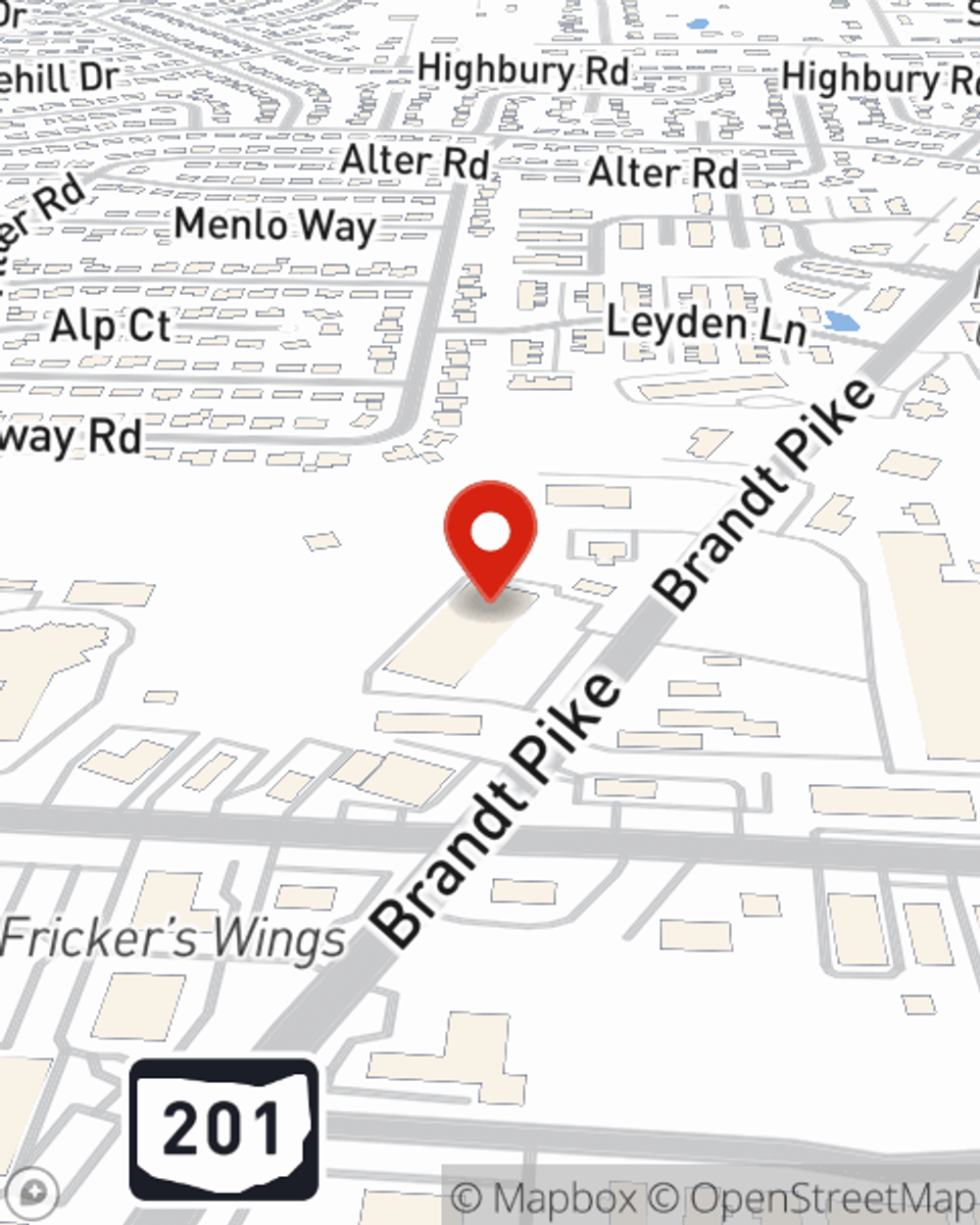

- Huber Heights

- Dayton

- Riverside

- Tipp City

- Trotwood

- Vandalia

- New Carlisle

- Fairborn

- Englewood

- Beavercreek

- Centerville

- Montgomery County

- Miami County

- Greene County

- Bellbrook

- Medway

- Troy

- Xenia

- Springboro

Cost Effective Insurance For Your Business.

The unexpected happens. It's always better to be prepared for the unfortunate catastrophe, like an employee getting hurt on your business's property.

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

Get Down To Business With State Farm

Our business plans rarely account for every worst-case scenario. Since even your brightest plans can't predict global catastrophes or natural disasters. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for uncertainty with a State Farm small business policy. Business insurance covers your business from all kinds of mishaps and troubles.. It protects your future with coverage like business continuity plans and a surety or fidelity bond. Terrific coverage like this is why Huber Heights business owners choose State Farm insurance. State Farm agent Ronnie Redd can help design a policy for the level of coverage you have in mind. If troubles find you, Ronnie Redd can be there to help you file your claim and help your business life go right again.

Don’t let the unknown about your business keep you up at night! Visit State Farm agent Ronnie Redd today, and explore the advantages of State Farm small business insurance.

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Ronnie Redd

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.